Last updated on August 27th, 2024 at 10:14 am

In today’s rapidly developing digital world, convenience, security, and seamless transactions are essential. Digital ewallet apps are changing the way to handle payments and financial activities. The prevalence of smartphones and the rising acceptance of contactless payments have boosted the need for user-friendly and secure digital ewallet apps. This comprehensive tutorial guides you through the procedures, costs, necessary features, and several benefits of developing a digital ewallet app. Whether you’re a developer, an entrepreneur, or a business striving to stay ahead in the digital age, this guide will help you deal with the difficulties of creating a digital ewallet app. Here is a complete guide to you about all the necessary points of create a digital ewallet app in 2024.

What Is A Digital eWallet?

A digital wallet is also known as e-wallet. The software program enables users to save and manage their financial information, such as credit card numbers and bank account information, and digital currencies on digital devices such as tablets, smartphones, and computers.

It facilitates a convenient and secure method of making electronic transactions such as online purchasing, money transfers, in-store payments, and peer-to-peer transactions.

Digital ewallets commonly work by securely storing the user’s payment data and encrypting it to protect against unauthorized access. The digital ewallet securely transfers the payment information needed to complete the transaction without disclosing private information to the merchants or receivers.

Digital eWallet App Development Stats

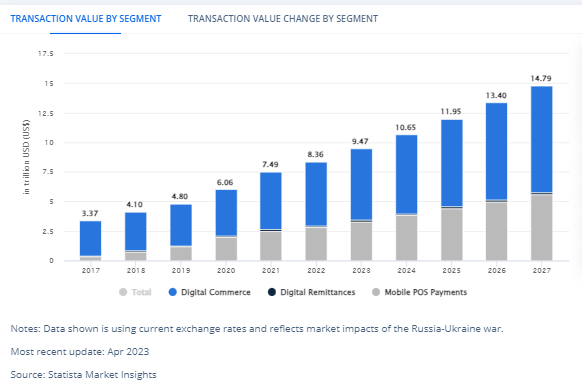

It is shown that the highest cumulative transaction value is attained at US$3,639.00 billion in 2023 from a worldwide comparison perspective. The overall transaction value in the market for digital payments is anticipated to reach US$9.46 trillion in 2023.

Digital eCommerce is the larger segment of the digital market, with US$6.03 trillion in total transaction value predicted in 2023. Between CAGR 2023 and 2027, the total transaction value is anticipated to increase by 11.80%.It will result in increasing estimated amount of US$14.78tn by 2027.

How Do Digital eWallet Applications Work?

From the perspective of users, the process of functioning digital wallet apps is as follows:

Installation and Set up

Users may download the digital wallet apps using the app store or the provider’s websites. You may install it on your smartphone or other digital devices. They develop an account by offering the required data like their name, email address, and sometimes financial details.

Adding Payment Method

After setting up the account, users can link their preferred payment methods in the digital wallet. Credit or debit cards, bank account details, or digital currencies can be considered. Users may be required to manually enter the relevant payment details or scan the card using the system’s camera.

Verification

To ensure security, the digital wallet app requires additional verification steps. It can confirm the user’s identity through methods such as two-factor authentication and biometric authentication (like fingerprint or facial recognition) or the unique verification code sent through text or email.

Loading Funds

After adding and verifying the payment methods, the users can load funds into their digital wallets. It can be related to transferring money from the linked bank account that deposits the funds from the credit cards or receiving the digital currency from another wallet. Some wallet also enables the users to get the funds from friends or family.

Making Payment

With funds loaded in the wallet, the users may initiate the payments. For online purchases, they may select the digital wallet as the payment method during the checkout on an app or website. The wallet securely transmits the payment data to complete the transactions.

Contactless Payment

Some digital wallet apps support contactless payments using NFC (near-field communication) technology when making payments at the physical store. The user must keep their devices near NFC-enabled payment terminals for making the transaction. Some wallets also generate unique QR codes that the merchant’s scanner can scan.

The digital wallet lets the users send the money directly to other individuals. The users can initiate the money transfer by entering the recipient’s email address contact numbers, and choosing them from their contact lists. The wallet securely transfers the money to the recipient’s wallet. They can keep the money in their wallet or transfer it to their bank account.

Managing Transactions

Digital wallets provide the features to manage and track transactions. Users can view the transaction history, check their balances, set spending limits, and get notifications for effective transactions or account activity.

Reason to Invest In Digital eWallet App Development

Investing in digital wallet app development may provide different benefits and opportunities for businesses in various industries. Let’s look at some of the basic reasons to invest in digital wallet app technology.

Rise In Contactless Payment

With the increasing adoption of contactless payment techniques, a digital wallet app lets businesses cater to changing consumer preferences and provides a convenient and secure way for users to transact without the physical touch.

Evolving With Cloud

The digital wallet can be cloud-based as it lets the users access the payment data and transaction history across multiple devices. This seamless integration may improve user accessibility and experience.

Core Processes Improvement

A well-developed digital wallet may streamline the core processes such as payment, financial management, and invoicing. Consequently, it improves the operational efficiency and reduces the administrative overheads.

Expand Customer Database

Businesses can use the digital wallet to capture valuable customer data, preferences, and behaviour. This data can be used for customized marketing efforts and enhance customer engagement.

Provide Improved Security

Modern digital wallet considers robust security measures such as biometric authentication and encryption. It gives users a sense of security and also aids in protecting their financial data.

Enhanced the Onboarding Process

A digital wallet may simplify the onboarding process for businesses that require user registration and account setup. Users may link their bank account and payment method seamlessly, declining the friction during signup.

Cost-Saving

Digital wallet apps can reduce the cost related to traditional payment methods like printing and distributing physical payment cards.

Investing in digital wallet app development allows businesses to meet evolving consumer preferences, streamline operations, and enhance security. It is a strategic way to stay competitive in a digital environment and aids the company in achieving potential success and growth.

Monetization Opportunities Offered By eWallet Apps

Digital wallet apps provide different monetization opportunities that can help you generate revenue while offering value to users. You must select a monetization strategy aligning with the value proposition and target audience.

The chosen model must provide value to users and generate sustainable revenue from the continuous development and growth of the app.

Let’s explore some monetization methods mainly used by digital wallet apps.

Transaction Fees

You may charge a small percentage or a fixed fee for each app transaction. This fee can apply to payments, bills, and money transfers. This strategy is highly effective for peer-to-peer money transfer apps.

In-App Purchases

Some digital wallet apps provide added features, premium services, and virtual goods that a user can purchase within the app. For instance, a budgeting wallet app may provide advanced features such as in-app purchases, customized budgeting plans or financial insights.

Subscription Models

A digital wallet can provide subscription plans granting users access to premium features, exclusive services, or improved security features. This recurring revenue model provides fixed income streams by offering added value to users.

Freemium Models

In this model, digital wallet apps facilitate the basic version of the app for free. However, users can pay fees to upgrade to the premium version with advanced features. The approach lets the users experience the core functionalities before paying for advanced features.

Advertisement

Digital wallets can integrate targeting advertising, endorsing the relevant products or services to the users. Ads pay the app owner for displaying the ads to their user base. However, this monetization method must be executed cautiously to eliminate the adverse impact on the user experiences.

Affiliated Marketing

This digital wallet app can partner with other businesses and promote their products and services using affiliated marketing. The app owner earns the commission when a user purchases using the affiliated link.

Partnership and Cross-Promotion

Digital wallet apps can partner with banks, retailers, financial institutions, and service providers. These partnerships can consider revenue-sharing agreements or mutual promotional efforts.

Types of Digital Wallet Applications with Examples

Each kind of digital wallet may serve different purposes and also cater to specific use cases. Whether you want to make payments, manage cryptocurrencies, or enable amounts between IoT devices, you can select the digital wallet app type per your development cost and project requirements.

Closed eWallet

A merchant or a business can issue a type of digital wallet app that can be used for transactions within their ecosystem. This app is limited to a specific brand or service and usually stores value in the form of loyalty rewards, prepaid balances, and gift cards.

Example: Starbucks Reward App: Customers can consider the Starbucks app to pay for purchases and earn rewards points within Starbucks locations. The application can be used within the Starbucks ecosystem.

Semi-Closed Wallet

A semi-closed wallet is another digital wallet app that can be used for making transactions with pre-specified merchant networks. While it is not restricted to a single brand, it has restrictions on the types of transactions and merchants. It enables them to make the transactions only on the listed location.

For Instance: Paytm began as a platform for mobile recharge and bill payments, but it has now expanded its offerings such as online shopping, utility bill payments, and many more. Users can use the Paytm wallet balance for different transactions within the Paytm landscape.

Open Wallet

It is a flexible digital wallet application that enables users to conduct business with various retailers and service providers on both online and off-line platforms. It is not limited to a specific brand or network.

Example: PayPal- a recognized open wallet that lets users link their bank account or credit cards. This app allows you to pay for merchants and individuals across other platforms.

Cryptocurrency Wallet

It is a cryptocurrency storage, transmission, and receipt app. It may securely handle the private keys needed to access and cryptocurrency holding management.

For instance, A digital wallet is made available to customers by the cryptocurrency exchange platform Coinbase, which allows them to purchase, sell, store, and manage a variety of cryptocurrencies including bitcoins, Ethereum, and many more.

IoT Wallet

It is used for securing the transactions between IoT devices. These digital wallets enable you to make microtransactions between IoT devices, permitting automated payment and interaction in the IoT ecosystems.

For example, IOTA is a cryptocurrency platform mainly intended for the Internet of Things. It aims to enable the feeless microtransactions and data integrity between IoT devices.

Must-have Features to Include While Building Digital Wallet App

The key features you have listed for digital wallet app development are inclusive and cover user, merchant, and admin panel aspects. Let’s check out a closer look at digital wallet app development features and their significance.

User Panel Features

This digital wallet app development feature enables users to transfer money, book tickets, do online shopping, bill payments, and pay directly to stores without physical contact using their smartphone. You can also share money with your friends and notify them to pay it back.

Let’s check out the user panel features of digital wallet app development.

| Features | Descriptions |

| Signup via Social Login | This feature lets users sign up using their current social media accounts. |

| User authentication | Multiple authentication options improve the security and convenience for the users. |

| Add Authorized Bank Account | Enables the users to link their bank account securely for easy money transfers and transactions. |

| Check Account Balance | offer real-time visibility into their account balances. |

| Transfer Money | Facilitates hassle-free money transfer through contact numbers or QR code scanning. |

| Bill Payment | Allow the user to make payments timely and set reminders for timely payments. |

| Transaction History | You can review past transactions for effective handling of finances. |

| Multi-Currency & Multi-Language Support | Attracts the broader audience by supporting the different currencies and languages. |

| Chat Support | Immediate customer support improves user experience and helps to resolve queries on time. |

| Push Notification | This feature informs you about offers, account activity, and updates. |

Merchant Panel Features

This panel considers every business category and ensures that you handle all aspects of customer experience. It can be integrated simply with eCommerce platforms.

Let’s catch up on the merchant panel features of digital wallet app development.

| Features | Description |

| Interactive Dashboard | Provides comprehensive ideas about the business operation to merchants |

| Product Management | Enables merchants to edit, add, and manage their products significantly. |

| Profile Management | Merchants can keep correct business profiles for better customer engagement. |

| Account Verification | This feature is similar to user authentication and enhances security for merchants. |

| Customer management | It allows merchants to create and handle customer relationships. |

| Promotional Offers & Discounts | Allows merchants to attract customers about special deals. |

| Loyalty points and rewards | Offering different loyalty programs to enhance customer retention. |

| Staff Management | Streamlining employee management for ease of business operations. |

| POS Integration | Integration to the point of sale enables in-store transactions. |

| Payment Link Generation | It simplifies the remote payment collection by generating payment links. |

Admin Panel Features

There are plenty of digital wallet app development features created for entrepreneurs. It is discussed below:

| Features | Description |

| QR Code Generation | Provides easy payment and transactions proceeding using the QR codes. |

| User & Merchant Control | Centralized management of user and merchant accounts for administrative intention. |

| Real-Time Analytics | Provides insights about transactions, app usage, and user behaviour. |

| Enhanced Security | Admin can execute the added security measures for safeguarding the app. |

| Reporting & Auditing | Create reports and conduct the audio for transparency and compliance. |

| Data Control | Admin has complete control over the users and merchants and aids in ensuring privacy and security. |

| Transaction Management | Check and Manage all the transactions for security and accuracy. |

| App Support & Maintenance | Admins support the users and merchants, ensuring the app’s horizontal functioning. |

| Dashboard Management | Admin can personalize and manage the database interface using this feature. |

| Offer Management | Manage the promotional discounts and offers for consistency and accuracy. |

These digital wallet app development features may collectively create an inclusive and functional digital wallet app that serves user needs, merchants, and administrators.

It is significant for prioritizing the security, user experience, and seamless integration of the functionality of successful digital wallet app development.

Process to Develop A Digital Wallet App

The development process for a digital wallet app considers several stages. Here, each step contributes to developing a functional and user-friendly app. Let’s break down the cycle:

Product Discovery

In this digital wallet app development step, the project team identifies the app’s purpose, specified audience, and features. Competitors assessment and market research help to shape the app’s unique selling points. The project scope, goals, and requirements are specified, and the roadmap for the development process is also outlined.

Designing

Under this digital wallet app development step, user experience and user interface design are considered. Designers create the prototyping, wireframing, and visual design that aligns with the app’s objectives and target audience. The designing step ensures a visually appealing and intuitive user interface.

Development

The development step considers to turn the design concept into a functional application. In this phase, developers write the code, execute the functionalities, and integrate APIs and third-party services. Based on the app’s complexity, both front-end and back-end development are considered.

To ensure the safety and protection of user data, security measures are executed in this digital wallet app development step. Please consult with our digital wallet app development company to effectively develop the digital wallet app.

Testing

Quality assurance is a significant step of digital wallet app development. Because it helps address the bugs and glitches and fix them before launching the app, you may use different types of testing across other platforms and devices, such as Functional, usability, security, performance, and compatibility testing are all types of testing. This phase ensures a smooth and bug-free user experience.

Digital Wallet App Launch

After testing and quality standards are completed, it is time to launch it in an app store such as Google Play Store or Apple. Developers create the app listings, upload the assets, and submit the application for review. The application is made available for users to use and download.

Maintenance and Support

Once the app is launched, the work doesn’t stop. Regular maintenance and support are essential for user feedback, bug fixes, releasing updates, and enhancing the app’s functionality. This step ensures the app remains secure, responsive, and up-to-date according to user requirements.

Collaboration among teams (such as designers, developers, testers, and marketers) is required during each step of digital wallet app development. Effective project management and communication tools support keeping the project on track and meeting deadlines.

Also, remember that user feedback plays a significant role during the process. Continuous feedback collection, assessment, and iteration aid to enhance the app’s features and user experience over time. Moreover, the security of digital wallet apps is of paramount importance.

Executing encryption protocols, robust security measures and compliance with data protection standards are significant to ensure the safety of user financial and personal data.

By using the above steps and user-friendly design with security aids to develop a successful digital wallet app that meets the needs of both users and merchants.

Most Popular Digital Wallets In the USA

There are multiple digital wallet apps used in the USA. These digital wallets have gained popularity due to their security and convenience features. It also integrates online and offline platforms. Users can select the one that best fits their preferences and devices for managing their payment, money transferring, and financial transactions.

Let’s take a closer look at each of them.

Apple Pay

Apple offers a mobile payment and digital wallet solution. You can make the transaction using this app using Apple devices such as iPads, iPhones, and Apple Watch. You can add their debit or credit cards to Apple Pay and ensure contactless payment in stores, apps, and websites supporting Apple Pay. The services integrate security, such as NFC and biometric authentications.

Google Pay

It is a Google-created online payment and digital wallet system. You can store their credit, debit, and loyalty cards in the app and pay via their Android devices. Google Pay includes contactless payments, online transactions, and in-app purchases. It also provides features such as peer-to-peer money transfer and integration with loyalty programs.

Amazon Pay

It has its own digital wallet and online payment services. It is mainly associated with making payments on Amazon platforms. Hence, it is used by other websites and merchants. You can store their payment and shipping details in their Amazon accounts.

Consequently, it lets you make convenient and secure payments across digital online retailers.

PayPal

It is one of the highly known digital payment platforms. This app facilitates digital wallet services and lets you link their debit or credit cards and bank accounts to their PayPal accounts.

You can send and receive payment from their contacts and shop online using the PayPal balance or linked accounts. It facilitates various financial services, such as business solutions and international money transfers.

Venmo

It is a highly recognized peer-to-peer payment app that emphasizes social payments. You can easily send money to family and friends, split bills, and make payments for different activities.

This app permits users to include comments and emojis while making transactions. It makes it a highly interactive payment experience. You can link their debit cards or bank accounts to fund Venmo transactions here.

Popular Technology Stack Used For Digital Wallet App Development

When it comes to developing the digital wallet app, different tech stacks can be used. Following are some examples of standard tech stacks used for digital wallet app development:

| Technology | Purpose |

| Programming Language | Kotlin (Android), Swift (iOS), and Java |

| Back-end Development | Ruby on Rails, Node.js, ASP.NET, and Laravel, Django |

| Framework | Flutter, React Native, etc. |

| Payment Gateway | PayPal, Stripe, Square, Paytm, Braintree |

| Database | MySQL, MongoDB, PostgreSQL, and Firebase |

| Push Notifications | Apple Push Notification Service and Firebase Cloud Messaging |

| Analytics | Firebase Analytics, Mixpanel, and Google Analytics |

| QR Code Scanning | ZBar Code Reader and ByteScout BarCode |

| Cloud Storage | Google Cloud Storage, Microsoft Azure Blob Storage, and Amazon S3 |

| Version Control | SVN and Git |

| Deployment | Google Cloud Platform (GCP), Microsoft Azure, and Amazon Web Services (AWS) |

| API Integration | GraphQL, Oauth, and RESTful APIs |

You can hire a mobile app developer to select the feasible tech stack, as it depends on the specific project needs, expertise, and other factors

What is the Cost of a Digital Wallet App Development?

The digital wallet app development cost depends on some factors. These factors are the app’s complexity, design, features, development team locations, and development approach. Let’s break down the cost considerations for developing the digital wallet app.

- Basic App (basic features): $20,000 – $50,000

- Medium Complexity App (Moderate features): $50,000 – $100,000

- Complex App (highly Advanced Features): $100,000 – $300,000+

The above cost considerations are rough estimations based on different factors. It is recommended to consult with the digital wallet app development company for highly accurate costs. It is customized as per the project requirements.

Conclusion

This technology’s transformative potential becomes even more precise as we reach the end of the tutorial on creating a digital wallet app. Due to ease, security, and innovation, digital wallet applications have risen to the forefront of contemporary financial transactions.

These applications have developed into a necessary tool for consumers and businesses due to their ability to improve user experience, optimize company processes, and accommodate changing consumer demands.

Each element of the process, from ideation and design’s early beginnings through the challenging phases of production, testing, and launch, helps to produce an effective and user-friendly app. Accepting the possibilities offered by digital wallet app development is not only a smart decision but also a necessary one as the digital world continues to change.

The advantages, which range from better client retention to effective money management, are evidence of the potential influence of a well-designed digital wallet software.

A digital wallet app is more than simply an application in today’s age of fast-moving innovation and more digital transactions; it’s a doorway to a time when users may access improved financial control and friction-less transactions.

Therefore, the world of digital wallet applications promises a safe, effective, and indisputably transformational future, whether you are starting a path as a developer, a business owner, or a customer seeking ease.

Naveen Khanna is the CEO of eBizneeds, a company renowned for its bespoke web and mobile app development. By delivering high-end modern solutions all over the globe, Naveen takes pleasure in sharing his rich experiences and views on emerging technological trends. He has worked in many domains, from education, entertainment, banking, manufacturing, healthcare, and real estate, sharing rich experience in delivering innovative solutions.